- Free Valuation

- Competitive Sales Commission Fees

- Free Mortgage Advice

posted 8th April 2023

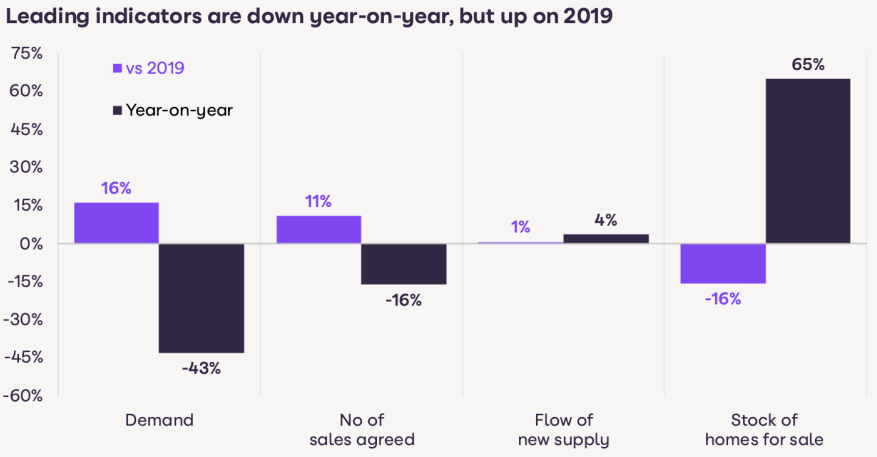

The sales market is seeing a return of buyers with more new sales being agreed. The demand for homes has reached its highest level since last October, which indicates a 16% increase compared to the same time in 2019. All areas are registering an improvement in market conditions. The areas that are more affordable, such as Scotland, Wales, the North East of England such as Manchester, and London, are seeing higher than average demand for housing.

The number of new sales being agreed upon, or homes sold subject to contract, is a more important indicator of market health. Currently, sales agreed are 16% lower than they were at this time last year (with demand 43% lower), but they are 11% higher than in 2019 and are on an upward trend. Last year, there was a severe shortage of homes for sale, which caused prices to increase but also hindered sales completions.

However, there are now 65% more homes for sale than there were a year ago, with the average estate agent having 25 homes available compared to just 14 at this time last year. This is a positive change that offers buyers more choice, but it also means that sellers need to price their homes sensibly if they want to sell. Sellers are making modest adjustments to their asking prices to match what buyers are willing to pay, and they are accepting an average discount of 4% or £14,000. Despite the significant price gains over the pandemic, this pricing adjustment is helping sellers to agree on sales, enabling them to move and supporting the sales market.

Compared to this time last year when the market was particularly strong, the time it takes to sell a home (from being first listed to going under offer) has increased by 71% or 15 days. However, in most areas, the time to sell still remains lower than 2019 levels. Scotland has the shortest sales periods at 28 days, as homes are marketed with a survey and valuation, while London has the longest time to sell at 44 days. These trends suggest a return to the levels of market activity seen in 2019.

Compared to this time last year when the market was particularly strong, the time it takes to sell a home (from being first listed to going under offer) has increased by 71% or 15 days. However, in most areas, the time to sell still remains lower than 2019 levels. Scotland has the shortest sales periods at 28 days, as homes are marketed with a survey and valuation, while London has the longest time to sell at 44 days. These trends suggest a return to the levels of market activity seen in 2019.

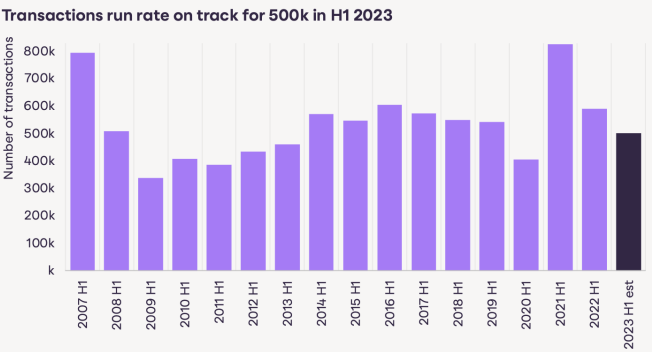

After new sales are agreed upon, it typically takes anywhere from 2 to 6 months for the sale to be completed, with the buyer receiving the keys and moving in. During this period, some deals may fall through, and homes may be resold to other buyers. Completions are significant since they drive estate agent commissions and mortgage lending. Based on our analysis of new sales data over the past 9 months, we are on track to achieve half a million sales completions in the first half of 2023. This rate suggests that we may see 1 million sales over the course of 2023, in line with our forecast, and significantly higher than the years following the global financial crisis of 2008-2011.

We are optimistic about the outlook for sales completions in 2023, as several factors support the desire to move:

- Working from home one to two days a week has become the norm for many office-based workers, allowing people to expand their search for a home beyond their previous limits and find better value for their money;

- The increase in retirement resulting from the pandemic has also acted as a catalyst for home moves.

- The cost of living pressures will continue to encourage some to downsize from larger homes that are costly to maintain. Overall, these factors suggest a favorable environment for sales completion in the coming year.

The housing market has seen a shift in the price bands that are experiencing the greatest increase in sales, driven by buyers seeking better value. Although mortgage rates have fallen, the average homebuyer has 20% less buying power compared to last year. This has resulted in buyers searching for better value-for-money areas, smaller homes, or using larger deposits to support their purchases. In the last month, the share of sales in the cheapest 40% of the market by price has increased, while the share of sales in the higher-priced top 40% of the market by price has dropped. This is evidence of continued demand from first-time buyers or second-steppers, as well as more caution on the part of existing homeowners. This trend is consistent across all regions and countries of the UK, with an average 5% increase in the share of sales at the lower end of the market and a 4% fall at the top end. Homeowners looking to upsize may be waiting to see what happens to the economy before entering the market as the cost of mortgage costs for a larger home is much higher.

Our research shows the growth of house prices is still decelerating, standing at 4.1% which is a significant decrease from 9% a year ago. The index has only slightly declined by 1% since October last year. The quarterly growth rate has been negative for the past three months, representing the slowest quarterly growth rate since 2011. The market is currently undergoing rapid repricing on a national level. Major cities have experienced a sharp decrease in annual growth rate, dropping from double digits a year ago to below 6% at present.