- Free Valuation

- Competitive Sales Commission Fees

- Free Mortgage Advice

posted 21st April 2024

The UK property sales market continues to exhibit positive momentum as various indicators demonstrate an upward trajectory in activity. New sales agreed have surged by 9% compared to the previous year, with an impressive 7% increase in home sales agreed during Q1 2024 compared to the same period in 2023. This burgeoning trend is stimulating more sellers to list their properties, resulting in an 11% increase in the average number of homes on the market per agent over the last four weeks, compared to the same period last year. Overall, there is a notable 20% surge in the number of homes available for sale compared to the previous year.

The buoyancy in the housing market sentiment can be attributed to accelerated real wage growth and a robust jobs market, both of which are bolstering consumer confidence. Recent data from the GfK survey indicates that consumer confidence regarding personal finances has reached its highest level in over two years. Concurrently, mortgage rates have experienced a significant decline, standing at 4.4% for a 75% loan to value 5-year fixed-rate loan, marking a decrease of over 1 percentage point from the peak observed in June 2023.

Sales activity is robust across various regions, with areas boasting more affordable house prices witnessing the most substantial growth. Regions such as Yorkshire and the Humber experienced an 11% surge in sales, while the North West recorded a notable 13% increase. Additionally, the South West and North East saw the most significant growth in new sellers listing homes, with increases of 28% and 26%, respectively. However, the supply of homes for sale in London saw a comparatively modest 8% increase, leading to a faster rebound in price inflation in the capital compared to other regions.

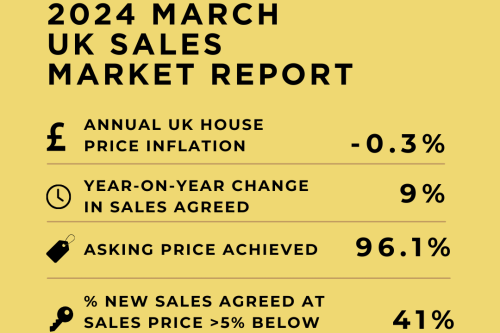

Despite the overall positive momentum in sales activity, the annual rate of UK house price inflation remains negative at -0.3%, albeit showing improvement from a recent low observed in October 2023. Regional disparities persist, with southern regions continuing to register annual price declines, particularly the Eastern and South East regions. Conversely, prices are witnessing the most significant increases in Scotland and Northern Ireland.

Buyers and sellers are increasingly agreeing on sales, indicating that house prices are stabilizing rather than experiencing accelerated growth. However, buyers remain price-sensitive, with 41% of sales agreed in March occurring at a price 5% or more below the asking price. Although this figure reflects an improvement from the previous quarter, it remains high compared to historical standards, suggesting that house price inflation is likely to remain static throughout 2024.

Moreover, the gap between asking prices and agreed purchase prices has narrowed, indicating improving market conditions. The average discount from the initial asking price to the agreed purchase price decreased from 4.5% in November 2023 to 3.9% in March 2024. This trend reflects both sellers' increased realism in setting asking prices and growing buyer confidence.

Looking ahead, the availability of a greater number of homes for sale is expected to keep price rises in check. The average estate agent now has almost 30 homes for sale, resembling pre-pandemic levels, providing buyers with more options and negotiation leverage. Additionally, a significant portion of homes for sale have been on the market for more than three months at the initial asking price, indicating the potential for price reductions to attract buyer interest.

In the latter half of 2024, lower interest rates are anticipated to further boost market sentiment and reduce mortgage rates. Rising household disposable incomes coupled with expected interest rate reductions are projected to enhance housing affordability. However, economists caution that sustained affordability will require incomes to continue outpacing house price growth, particularly in southern England.

Overall, the UK property sales market exhibits resilience and positive momentum, driven by improving consumer confidence, declining mortgage rates, and a growing supply of homes for sale. While challenges persist, particularly in regions experiencing price declines, the market outlook remains cautiously optimistic as it navigates through the evolving economic landscape.