- Free Valuation

- Competitive Sales Commission Fees

- Free Mortgage Advice

posted 16th February 2023

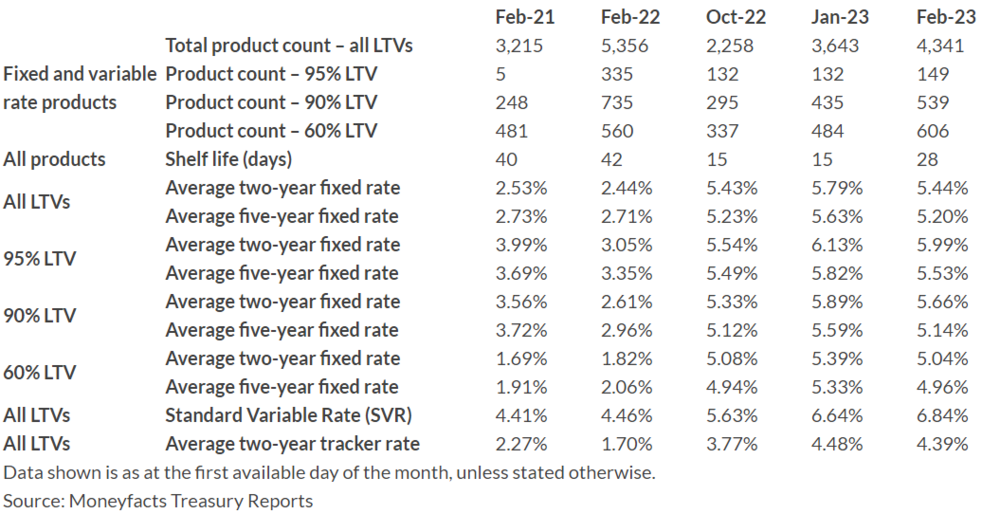

The UK mortgage market has experienced a significant increase in product choice, with over 4,000 options now available, up from 3,643 in January 2023. This is the first time the total number of mortgage products has surpassed 4,000 since August 2022, indicating greater stability in the market following the mini-Budget in September 2022.

Within specific loan-to-value (LTV) tiers, availability within the 60% LTV tier has reached its highest level in three years.

The average shelf life of a mortgage product has also increased to 28 days, compared to 15 days a month ago, reflecting increased stability among lenders. Both the average two- and five-year fixed mortgage rates have fallen for the third consecutive month, with the average five-year fixed rate 0.24% lower than the average two-year equivalent. The difference between these two rates is the largest margin seen in almost 15 years.

However, the average 'revert to' rate, or Standard Variable Rate (SVR), continues to rise, reaching 6.84%, the highest on Moneyfacts records since October 2008. The gap between the average two-year fixed rate mortgage from two years ago and the current average SVR has also widened to 4.31%.

Rachel Springall, a finance expert at Moneyfacts, suggests that borrowers on both ends of the loan-to-value tiers can now find lower rates and more choices, but it may be wise to wait for rates to come down further.

Borrowers currently on their revert rate may benefit from switching to a fixed deal to reduce monthly repayments and gain peace of mind. Springall advises borrowers to seek advice to consider all the available options, as fixed interest rates are expected to fall in the coming months.