- Free Valuation

- Competitive Sales Commission Fees

- Free Mortgage Advice

posted 1st April 2023

The rental market is experiencing a high level of demand and activity.

The UK's residential rental market has experienced a perpetual boom for the past two years, with rents continuing to rise well ahead of earnings growth. Average rents for new-lets have increased by 11.1% in the last 12 months, while earnings have only increased by 6.7%. Although rental inflation has slightly slowed from its mid-2022 peak of 12.3%, there are no signs of any imminent slowdown. Rents have risen by 20% in the past three years, an extra £2,220 a year, which is an ongoing concern for renters, especially those on lower incomes and/or in receipt of housing benefits.

What is driving the boom in rental demand and why we are not seeing a supply-side response. The key questions are: 1) when will we see rental growth slow? and 2) is there a risk that the rapid rise in rents means landlords over-shoot and need to recorrect in the future?

Immigration and overseas students boost rental demand

Rental demand has accelerated since mid-2021, primarily due to the strength of the jobs market, which has over 1 million vacancies according to the latest ONS data. Although many jobs are filled by UK nationals, the world's advanced economies are increasingly looking to immigration to fill highly skilled jobs. In early 2021, the UK government conducted a major shake-up of visa rules to attract skilled talent. This was one of the drivers of record-high net immigration totaling 504,000 people in the year to June 2022. This was further boosted by humanitarian schemes supporting Ukrainians fleeing the war and a specific visa scheme for British Overseas citizens looking to leave Hong Kong and move to the UK.

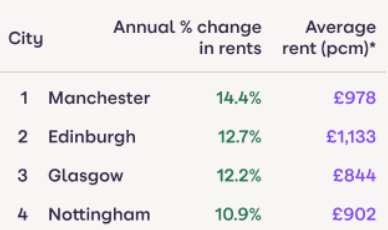

Overseas students studying in the UK totaled 680,000 in 2021/22, up 122,000 in two years thanks to new visa rules. This group is a lucrative market for universities and part of the strategy to attract talent to the UK. However, there is a widely reported supply/demand imbalance for purpose-built student accommodation (PBSA) due to the growth in student numbers. This means student demand spills over into the wider rental market, boosting rental demand in the summer months, which was particularly strong in 2022 as international borders continued to reopen. This explains why rental inflation has remained strong across major UK cities.

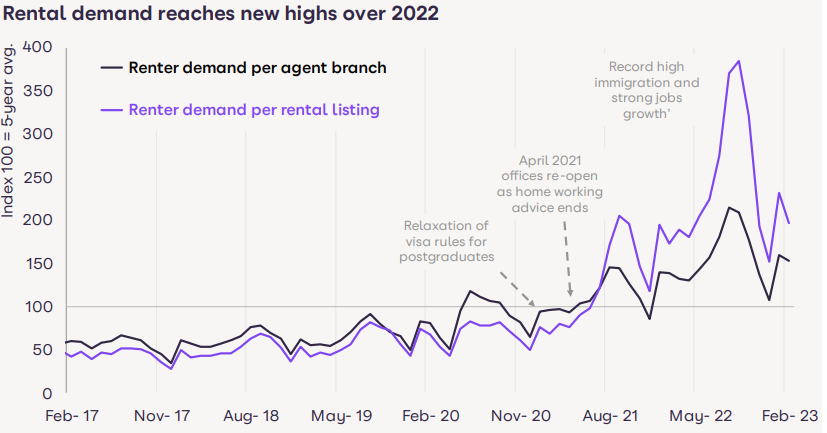

Demand for rented homes, and rental inflation, took off as the economy reopened in the spring of 2021 and new visa rules attracted a major inflow of students and others for work. Our core measure of rental demand - inquiries received per estate agency branch - peaked in summer 2022 at double the 5-year average. However, with a third fewer homes available for rent than normal, demand per available rental home spiked even higher last year by 250% above the 5-year average. Demand for rented homes remains 10% higher than this time last year. Rents will continue to rise ahead of incomes unless we see a sustained increase in rental supply or a material weakening in demand, both of which appear unlikely at this stage.

While demand has increased, the number of privately rented homes remains largely static. In 2021, there were 5.5 million privately rented homes in Great Britain, slightly more than the 5.4 million total in 2016. This follows a doubling in the number of privately rented homes between 2002 and 2015, driven by landlords using buy-to-let mortgages. In simple terms, a static supply of rented housing means a new investment that adds to supply is offset by property leaving the sector, as landlords dispose of rented homes as part of ongoing portfolio rationalization or exit the rental market altogether.

Fresh capital allocated towards maximizing revenue and yield.

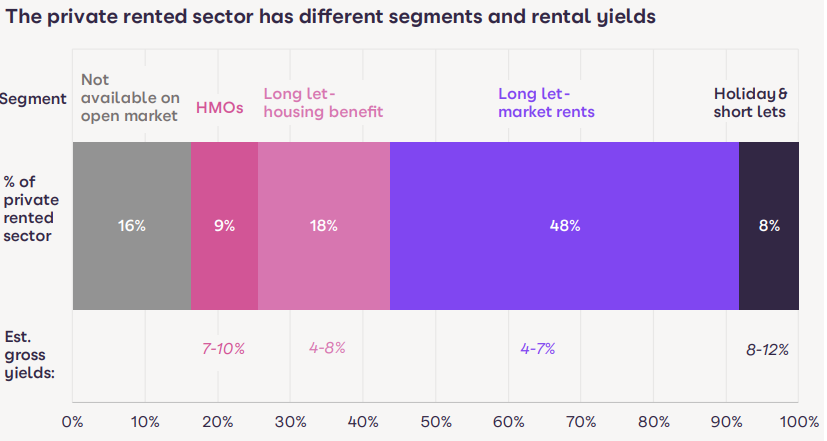

Those who continue to invest are focusing on buying lower-value homes with higher rental yields or targeting segments of the rental market that deliver higher revenues and stronger cashflow potential.

The private rental market in the UK can be broken down into different subsectors, including long-term lets, holiday/short lets, and houses in multiple occupation (HMOs). Almost one million homes are not available on the open market, as they are rented as part of a job or let under secure long-term tenancies. We estimate up to 8% of rented homes operate in the holiday/short-let sector, where revenues are higher, but so are running costs. HMOs are single dwellings where people rent a room and share other facilities. Revenues and yields are higher than a typical buy-to-let property, but these properties are subject to local licensing schemes and incur higher management costs.

The 'core' private rented sector is the long-let market, where renters pay an open-market rent and take initial tenancies of 6-12 months. Rental yields are lower in this segment, but it delivers almost half of all rental supply. Within the long-let market, approximately 25% of renters are in receipt of housing benefit, and rents are set by the government at the low end of the market.

Book your free rental appraisal with us today to gain a current rental valuation of your buy to let property!