- Free Valuation

- Competitive Sales Commission Fees

- Free Mortgage Advice

posted 11th March 2023

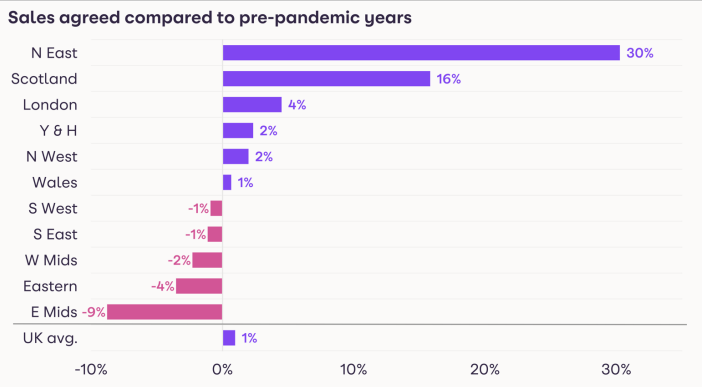

From a year-on-year perspective, businesses can benchmark how they are faring compared to the previous year. Our data reveals that homebuyer demand has rebounded in the first two months of 2023, although it remains at 50% of the level recorded a year ago. New sales volumes have also recovered, tracking the usual seasonal upturn but are 24% lower than last year. However, when compared to pre-pandemic years (2017-2019), demand is up by 8%, and sales agreed have increased by 1%, making it a more useful benchmark for businesses planning strategies and investment decisions.

The stock of homes for sale has increased by over 60% compared to last year due to slower sales and a steady flow of new supply. The average estate agent office has 24 homes for sale compared to just 15 a year ago. This has created more choices for home buyers, who now have more room to negotiate on price, helping reduce the upward pressure on house prices. Over 40% of homes currently listed for sale on Zoopla have seen their asking prices reduced to attract price-sensitive buyers, with adjustments being broadly uniform across regions and property types.

Sales volumes are higher than in pre-pandemic years in more affordable housing markets, such as the North East and Scotland, where higher mortgage rates have less of an impact on demand.

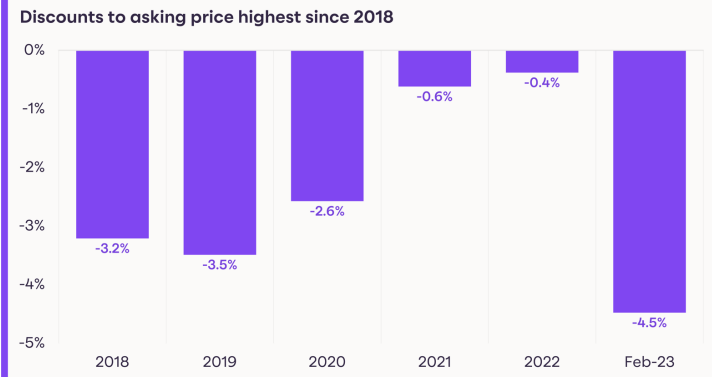

While sales volumes have recovered, sellers are having to accept larger discounts to the asking price to secure sales. The discount to achieve a sale has increased over the last five months and currently stands at 4.5% - an average £14,100 discount per sale. This reflects the rapid transition from a hot seller's market to a buyers' market with more negotiation on price. The average UK home grew in value by £42,000 over the pandemic, suggesting sellers are having to forgo, on average, 33% of their pandemic gains to achieve a sale.

As the market adjusts to the reduction in buying power resulting from higher mortgage rates, nationwide repricing is underway, resulting in a soft reset in house prices. Buying power is starting to recover as mortgage rates fall from their 6% highs of late 2022. However, at 4% mortgage rates, the average home buyer has 20% less buying power than they did a year ago when mortgage rates were 2%. House price indices have started to pick up the decline in agreed prices over recent months. The house price index is now registering modest monthly price reductions which have dragged the annual rate of inflation lower to 5.3%. The index is expected to continue showing small month-on-month price reductions over the next 2-4 months as a soft reset in house prices continues. By summer, the index is anticipated to record modest annual price reductions of up to 2 or 3%.