- Free Valuation

- Competitive Sales Commission Fees

- Free Mortgage Advice

posted 19th January 2026

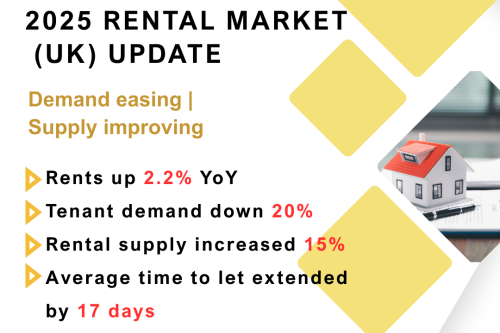

Market Overview

The Manchester rental market closed 2025 in a period of adjustment, as tenant demand eased and rental supply improved. This rebalancing has slowed rental growth and extended letting times, marking a shift away from the intense competition seen over recent years.

Nationally, rents rose 2.2% over the last 12 months, the slowest annual rate of increase in four years. Manchester and the wider North West continue to outperform many regions on growth, but at a more sustainable pace.

Tenant Demand at a Multi-Year Low

Tenant demand has weakened significantly over the past year and is now at its lowest level for this time of year in six years.

Key factors behind this shift include:

- Tenant demand down by around 20% year-on-year

- A sharp reduction in net migration, which traditionally feeds the private rental sector

- Fewer international students and workers entering the UK rental market

Official estimates show net migration fell dramatically over two years:

- From 924,000 (year to June 2023)

- To 204,000 (year to June 2025)

This decline has had a direct and measurable impact on rental demand across major cities, including Manchester.

First-Time Buyers Freeing Up Rental Stock

A second driver of reduced demand is improved mortgage affordability for first-time buyers.

- Over 350,000 people are expected to buy their first home in 2025

- First-time buyer mortgage numbers increased by 20% in the nine months to September 2025

- Many of these buyers were previously renting, releasing homes back into the rental market

While this trend benefits higher-income renters able to transition into homeownership, lower-income households remain reliant on private renting as their primary housing option.

Rental Supply Recovers

Rental supply has increased meaningfully, easing the acute shortages seen in recent years.

- National rental supply is 15% higher than a year ago

- The average estate agency branch is now marketing 14 rental properties

- This is an improvement from the 2022 low of 8, but still below the pre-pandemic norm of 17

In the North West, including Manchester:

- Rental availability is up over 20%

- Supply growth reflects strong first-time buyer activity and homes failing to sell being redirected into the rental market

This increase in choice means tenants are becoming more selective, placing greater emphasis on property condition, pricing, and presentation.

Time to Let Continues to Lengthen

The shift in supply and demand is clearly reflected in letting times.

- Average time to let has increased to 17 days

- This is almost 20% slower than a year ago

- Letting times are 42% slower than during the pandemic-era rental surge

Across the UK, average letting times now range:

- From 14 days in Scotland

- To 19 days in the West Midlands

For Manchester landlords, reducing void periods through accurate pricing, strong marketing, and efficient tenant processing is becoming increasingly important.

Rental Growth Slows but Remains Positive

Rental inflation has slowed across all regions as affordability pressures and increased supply take effect.

- UK rents rose 2.2% year-on-year, down from 3.3% last year

- This represents the slowest growth rate in four years

- The average UK rent for new lets now stands at £1,320 per month (£15,840 per year)

In regional terms:

- North West rents rose by 3.2%, outperforming the national average

- More affordable regions continue to see stronger growth due to greater headroom

- Higher-value markets are experiencing slower growth or price declines

This pattern reflects local affordability constraints rather than a lack of demand.

Rents Now Rising More Slowly Than Earnings

Over the long term, rents tend to track earnings growth. However, rapid rent increases during 2022–2023 pushed affordability to its limits.

The market has now shifted:

- Rent growth is running below earnings growth

- This trend is expected to continue into 2026

- Affordability is gradually repairing across the rental sector

For landlords, this supports:

- More predictable rental income

- Lower tenant turnover

- Reduced reletting and void costs over the long term

Regional & Local Variations

Rental performance varies widely by region and local authority.

Fastest growth is seen in more affordable areas:

- North East: +4.5%

- North West: +3.2%

- Strong local growth in lower-value markets such as Carlisle, Chester, and Motherwell

Slower growth or declines are seen in higher-value areas:

- London: +1.6%

- West Midlands: +1.7%

- Scotland: +1.7%

- Some cities recording falling rents, reflecting affordability ceilings

Manchester continues to benefit from relative affordability compared with southern markets, supporting ongoing demand despite broader market softening.

Outlook for 2026

The rental market is moving back toward more balanced and sustainable conditions.

- Rental demand and supply are normalising

- A modest supply shortfall remains

- National rent growth forecast for 2026: +2.5%

Key considerations for landlords:

- New landlord investment remains limited

- The total number of rental homes has remained broadly unchanged for a decade

- Regulatory and legislative changes will play a growing role in portfolio decisions

Rental affordability is expected to return to pre-pandemic levels during 2026, improving tenant choice while helping to contain excessive rent inflation.