- Free Valuation

- Competitive Sales Commission Fees

- Free Mortgage Advice

posted 17th October 2024

Mortgage Rates & Market Activity

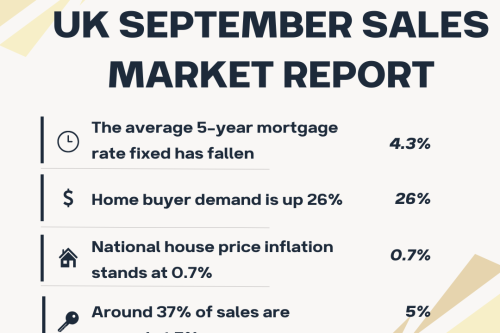

Home buyers are benefiting from the lowest average mortgage rates in over a year, with the rate for a 5-year fixed mortgage at 75% loan-to-value (LTV) now standing at 4.3%, a decrease from 5.5% this time last year. The competitive mortgage landscape, especially for those with significant equity, is driving increased activity in the housing market. Nationally, home buyer demand has risen by 26% compared to last year, with the number of agreed sales increasing by 25%.

In Manchester, this increase in buyer activity mirrors national trends, as many homeowners who postponed moving decisions during recent market uncertainty are now re-entering the market.

House Price Inflation

While sales volumes are on the rise, house price inflation remains relatively modest, at 0.7% nationally. This marks an improvement from the -0.3% recorded a year ago, though affordability continues to be a constraint on price growth, especially in southern regions of the UK. However, Northern regions, including Manchester, are seeing better performance, with home values in some areas up by as much as 2.2%.

Notably, Northern Ireland has seen a significant 5.7% rise in home values, while London, after a year of price declines, has shifted to modest growth of 0.5%.

Supply & Price Sensitivity

The availability of homes for sale has increased by 12% compared to last year, helping to support the growing sales activity. However, not all these homes are fresh listings; around 20% of properties on the market were previously listed within the past two years. Buyers remain price-sensitive, with many homes still undergoing price reductions of 5% or more to attract interest. This price sensitivity means sellers must remain realistic in their pricing expectations to secure a timely sale.

Chain-Free Sales & Investor Trends

A notable trend is the rise in chain-free sales, with 32% of homes on the market being chain-free. In London, two and three-bedroom houses are most likely to be chain-free, while smaller flats dominate outside the capital. Landlords facing higher mortgage rates and weaker rental yields, particularly in London and the South East, are contributing to this trend, with 13% of homes for sale being former rental properties.

Additionally, upcoming tax changes, such as the potential doubling of council tax for second homes in certain areas, have prompted an increase in supply in coastal and rural locations, with supply increasing by 40% in some areas.

Buyer Offers & Future Outlook

While the market is seeing more activity, buyers are still negotiating hard on price. Around 37% of sales are being agreed at more than 5% below the initial asking price, indicating that while prices have firmed, there remains room for negotiation. Looking ahead, single-digit house price inflation is expected, driven by steady sales volumes and a gradual improvement in affordability.

Expectations of lower mortgage rates are encouraging more would-be buyers to enter the market, with some lenders now offering rates below 4%. Mortgage rates are expected to stabilize in the high 3% to low 4% range in 2025, which, combined with rising household incomes, will further improve affordability and support continued sales growth.

Outlook for Manchester

For our Manchester-based market, the outlook is increasingly positive. With more properties coming to market and mortgage rates becoming more favorable, there is an opportunity for both buyers and sellers to capitalize on the renewed market activity. However, sellers should remain mindful of current pricing trends and ensure that their properties are competitively priced to secure a sale in this evolving market.

In conclusion, the housing market is stabilizing after a period of uncertainty, with rising sales volumes and modest price growth setting the tone for the coming months. While challenges remain, the outlook is brighter than it was a year ago, offering a more positive environment for both buyers and sellers alike.