- Free Valuation

- Competitive Sales Commission Fees

- Free Mortgage Advice

posted 3rd December 2024

The UK property rental market continues to experience significant fluctuations, with both rents and housing prices showing notable trends in the face of ongoing economic challenges. As of November 2024, our report will provide key insights into the current rental landscape across the country.

National Overview: UK Rental Price Growth

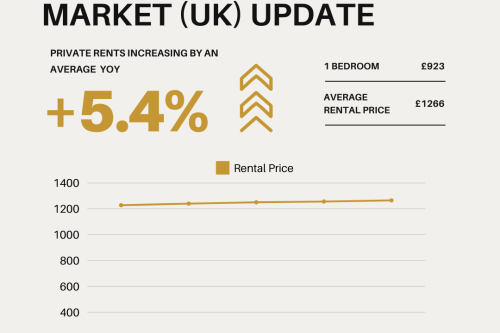

The rental market in the UK continues to see inflationary growth, with private rents increasing by an average of 5.4% year-on-year to November 2024. This marks a continuation of the trend observed in recent months, as rent increases remain above the level of overall inflation. The rising costs reflect a complex combination of factors, including economic instability, high demand for rental properties, and challenges in meeting the need for new housing construction.

Key national trends include:

Increased Demand

There is persistent demand for rental housing across many urban centres, driven by factors such as migration to cities, the return to office working, and continued job growth in sectors like technology, healthcare, and finance.

Limited Supply

Housing supply has struggled to keep pace with demand, contributing to higher rental prices. Many areas are experiencing shortages of available rental properties, exacerbating the imbalance between supply and demand.

Manchester Rental Market

Manchester, one of the UK’s most prominent rental markets, has seen significant growth in private rental prices, outpacing the national average. In Manchester, rental prices also continue to rise, reflecting the city’s high demand and limited availability of properties. The average monthly rent for a one-bedroom property is approximately £923, while a two-bedroom property averages £1,140. Larger properties are seeing higher rates, with the average rent for a three-bedroom home standing at £1,320 and a four-bedroom or larger property fetching around £1,893. On average, the rent across all property types in Manchester is approximately £1,266 per month. These figures underscore the competitive nature of the rental market in Manchester, which remains one of the key urban hubs outside of London.

Several factors are contributing to the rise in rents in Manchester:

High Demand for Housing: Manchester continues to attract a diverse range of tenants, from professionals working in sectors like technology and finance, to students attending the city’s universities. As one of the most rapidly developing cities in the UK, demand for both short-term and long-term rentals remains strong.

Economic and Job Growth: The city's thriving economy, particularly in areas like the digital sector, healthcare, and financial services, drives continuous migration to the area. The growing number of businesses establishing offices in Manchester contributes to this influx, increasing demand for rental properties.

Limited Property Stock: Despite high demand, the supply of rental properties in Manchester has not expanded at the same pace. New developments are still catching up to the demand, leading to a lack of available housing, particularly in desirable city centre locations.

Regional Housing Affordability: Although Manchester's rents are rising, they remain lower than those in London or the South East, making the city an attractive alternative for tenants seeking urban living with relatively more affordable housing. However, rising rents still present challenges for renters, especially for lower-income groups.

Regional Variations in Rental Prices

Across the UK, rental price growth is not uniform. While major cities like Manchester, Birmingham, and Leeds have seen significant rises in rent, rural areas and smaller towns have experienced more modest increases. In the North West region, which includes Manchester, rent growth has been notably higher than in other parts of the country. Larger urban centres continue to see a higher demand for rental properties, which drives prices up.

On the other hand, smaller, less densely populated areas have not witnessed the same levels of inflation, reflecting a regional divergence in the rental market. This highlights the ongoing trend of urbanisation, with more people moving into city centres, further contributing to the pressure on rental prices.

Rental Affordability and Tenant Challenges

With rising rental prices, affordability remains a significant concern for many tenants, particularly in cities like Manchester. The sharp increase in rents over the past year has stretched budgets, especially for younger professionals, families, and students.

Wage vs Rent Growth: Although wages have been rising in certain sectors, they have not kept pace with the rate of rent increases. This widening gap between income and rent has led to more renters seeking smaller properties or relocating to more affordable areas on the fringes of cities.

Cost of Living Pressures: The broader cost-of-living crisis, with rising energy bills and inflation in other sectors, has made housing even less affordable for many. Tenants are increasingly looking for cost-saving measures, with shared accommodation and flexible rental agreements becoming more common.

Regional Migration: Many renters are being priced out of highly sought-after areas and moving to suburban or outlying regions where rental prices are more affordable. This has led to an increased demand for properties outside of central urban areas, contributing to growth in rental prices in some suburbs.

Looking Ahead

As we move into the winter months, experts anticipate that the property rental market will remain relatively stable, with moderate growth expected for the remainder of 2024. Factors such as the broader economic outlook, inflationary pressures, and potential changes in government policy could influence rental trends in the coming months.

However, for tenants looking for affordable options, the market is expected to remain competitive, with rent increases continuing to outpace wage growth in many areas. Landlords will likely continue to adjust their pricing strategies to balance rising costs while maintaining tenant demand.