- Free Valuation

- Competitive Sales Commission Fees

- Free Mortgage Advice

posted 6th June 2024

Rising Supply Helps Stabilize House Prices

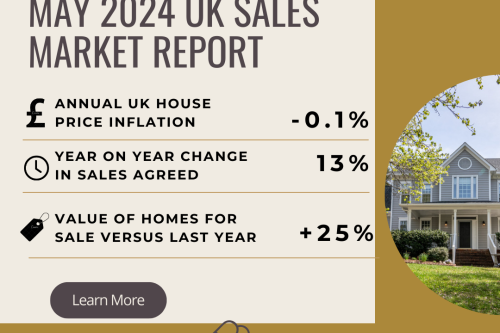

The UK property market has experienced increasing activity, with the number of agreed sales up year-on-year across all regions. This growth in market confidence is coupled with a rising influx of new properties, which is outpacing sales. As a result, house prices have remained relatively stable, showing a slight decline of 0.1% over the past year. The ongoing increase in supply is expected to continue moderating house prices.

Market Value and Stock Levels

In May 2024, the total value of homes for sale in the UK reached £230 billion, marking a 25% increase from last year. This surge in value is attributed to a notable recovery in the supply of 3 and 4-bedroom family homes, which had been scarce during the pandemic. The number of available homes is the highest it has been in eight years, with the average estate agent now listing 31 homes, a 20% rise compared to the previous year.

Factors Influencing Supply

Many homeowners had postponed their moving plans in the latter half of 2023 due to concerns over higher borrowing costs and their impact on house prices and buyer demand. However, a decline in mortgage rates, combined with increased sales volumes and firmer pricing, has encouraged more sellers to return to the market. Notably, nearly a third of the current listings are properties that were also on the market in 2023 but did not sell. Of these, 43% have reduced their asking prices by more than 5% to attract buyers, highlighting the necessity of realistic pricing strategies.

Regional Trends and Supply Dynamics

The sales market has seen a 13% increase in agreed sales compared to last year, although the growth in new listings has generally outpaced this rise. For instance, the South West of England has recorded a 33% increase in homes for sale, partly driven by tax changes affecting holiday lets and second homes. This region, with a high concentration of holiday properties, has seen a significant influx of new listings.

House Price Trends

The overall increase in housing supply is expected to keep house price inflation in check for the rest of 2024. The UK house price index shows a slight annual decline of 0.1%, with a quarterly increase of 0.4% as of April 2024. Despite this, the pace of quarterly growth has slowed, and house price inflation is projected to remain flat throughout the year.

Regional Price Variations

House prices across southern England continue to decline, contrasting with modest gains in other parts of the UK. City-level analysis reveals a range of annual house price changes, from a 3% decrease in Ipswich to a 3% increase in Belfast. This variation reflects the differing levels of affordability and the impact of higher mortgage rates, especially in coastal cities and those that saw increased demand during the pandemic.

Impact of the General Election

The early announcement of a general election on July 4, 2024, has introduced some uncertainty into the market. Historically, elections tend to slow market activity. However, with 392,000 homes currently in the sales pipeline, 3% more than last year, the impact is expected to be limited. First-time buyers and those looking to upgrade from rental properties remain motivated by high rental costs and improving mortgage conditions.

While some buyers may delay their decisions until after the election, the overall market is not expected to be significantly affected. The focus remains on how political parties will address housing supply and rental sector reforms. Sales completions for 2024 may fall slightly short of the anticipated 1.1 million, but the demand for housing continues to drive market activity.

Conclusion

The UK's property market in May 2024 is characterized by rising supply and stable house prices. Increased listings, particularly of larger family homes, and a slight dip in mortgage rates have invigorated the market. While regional variations persist, and the upcoming general election introduces some uncertainty, the overall trend points to a balanced market with moderate activity and controlled price inflation.