- Free Valuation

- Competitive Sales Commission Fees

- Free Mortgage Advice

posted 4th July 2025

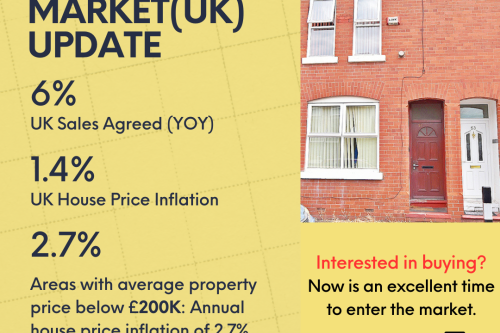

The Manchester housing market continued to demonstrate resilience through June 2025, with sales activity running at the strongest pace seen in the past four years. Sales agreed across the UK are up6% year-on-year, and Manchester is no exception. Despite a seasonal slowdown expected through the summer, market momentum has been sustained by strong buyer demand and a growing number of listings.

Sales Momentum vs. Slowing Price Growth

While the volume of sales being agreed remains high, this has not translated into faster house price growth. House price inflation across the UK has slowed to 1.4% in the 12 months to May 2025, a modest rise compared to the 0.3% increase recorded a year ago, and down from 2% in February. The Manchester market reflects this national trend.

One of the key drivers behind this deceleration is the 14% year-on-year increase in the number of homes for sale, which has provided buyers with more options and therefore limited the upward pressure on prices. Buyers in Manchester are remaining highly price-sensitive, a trend that is especially pronounced in higher-value areas due to affordability challenges.

Regional and Price Sensitivity Insights

Affordability continues to be a major influence on house price trends. In areas where the average property price is below £200,000, annual house price inflation is tracking at 2.7%, while areas with average prices between £200,000 and £250,000 are seeing 1.9% growth. These more affordable markets are experiencing stronger demand and have thus supported higher levels of price growth.

This is reflected in the North West, where local areas such as Wigan (WN) and Blackburn (BB) have seen prices rising by over 3.5% annually. These markets also avoided the price drops seen during the mortgage rate spikes of 2023 and early 2024, in contrast to higher-value regions.

Time to Sell and Seller Strategy

In Manchester, sellers must be realistic about pricing to achieve timely sales. Nationally, the average time to sell is 45 days, comparable to last year. However, there is increasing variation based on region and price band. Over 1 in 5 homes (22%) currently listed for sale have remained unsold for more than six months, often due to pricing that does not align with current buyer expectations.

There is still a robust pool of motivated buyers, but they are exercising caution and are less likely to stretch on price—particularly as the average homebuyer must now navigate stricter affordability tests and rising living costs. Encouragingly, recent changes to how lenders assess affordability have increased mortgage borrowing capacity by up to 20%, which may help close the affordability gap and support transactions in the second half of the year.

Outlook and Recommendations

The outlook for the remainder of 2025 remains cautiously optimistic. The market is on track for 5% more sales compared to 2024, driven by buyer intent and improved mortgage capacity. However, house price growth is expected to remain moderate, ranging between 1–2%.

In Manchester, where stock levels are growing and buyer sensitivity remains high, realistic pricing will be essential. Serious sellers should work closely with agents to reassess marketing strategies and adjust pricing in order to generate interest and avoid prolonged time on the market.