- Free Valuation

- Competitive Sales Commission Fees

- Free Mortgage Advice

posted 5th March 2025

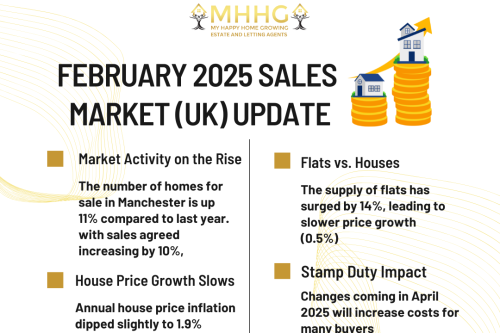

The Manchester property market continues to gain momentum in early 2025, with significant increases in both sales activity and housing supply. Compared to the same period in 2024, the number of homes for sale has risen by 11%, while sales agreed are up by 10%. This surge in market activity is driven by strong economic conditions, including rising consumer confidence, wage growth, and higher retail sales.

Manchester House Price Trends

While the market remains active, house price inflation has slightly dipped. The annual house price increase stood at 1.9% in January 2025, down from 2.0% in December 2024. The North West continues to outperform many other UK regions, recording a 3% annual rise in house prices, while Northern Ireland leads with a 7.2% increase. In contrast, house prices in London and southern England have seen slower growth, with gains of just 1% to 1.2% over the last year.

This moderation in house price inflation is partly due to shifting economic conditions, including the impact of the Autumn 2024 Budget and a 0.5% increase in mortgage rates since September 2024. Additionally, upcoming stamp duty changes in April 2025 are influencing buyer behavior, leading to more cautious pricing negotiations.

How Stamp Duty Changes Will Impact Manchester’s Market

From April 2025, new stamp duty rates will result in additional costs for many homebuyers. Half of homeowners will pay at least £2,500 more per purchase, with two-fifths of first-time buyers also facing higher stamp duty fees. These increased costs are likely to be shared between buyers and sellers during negotiations, which could help moderate house price inflation throughout the year.

Flats vs. Houses: What’s Selling Faster?

A key trend in early 2025 is the sharp rise in the number of flats being listed for sale. The supply of flats has increased by 14%, while house listings have grown by only 5%. Despite this, demand for houses remains significantly stronger, up 16% year-on-year, whereas buyer interest in flats has only increased by 1%.

This supply-demand imbalance explains why flats have seen just a 0.5% price increase in the past year, compared to a 2.2% rise in house prices. Furthermore, 15% of flats currently on the market are listed at a lower price than their previous purchase price, highlighting the slower capital appreciation of flats compared to houses.

The Growing Gap Between House and Flat Prices

The preference for houses over flats has widened the price gap between the two property types to a 30-year high. While the average house price in the UK now stands at £319,500, the average flat price is £191,300—meaning houses are 67% more expensive than flats. Over the past five years, house prices have surged by 24%, while flats have only increased by 7%.

Despite this, flats still present a strong affordability advantage, especially for first-time buyers. In major UK cities, mortgage repayments for flats are 43% lower than renting, yet demand for flats remains weaker compared to houses. In 2017, 44% of first-time buyers outside London wanted a three-bedroom house, a figure that increased to 52% by the end of 2024.

Manchester Property Market Outlook

Looking ahead, the Manchester housing market is expected to remain strong throughout 2025 and into 2026. With average wage growth of 6% over the past year—outpacing inflation—buyer confidence remains high. The increased availability of homes is giving buyers more choices and negotiating power, which, combined with the impact of rising stamp duty costs, should keep house price inflation at a steady 2-2.5%.

Key Takeaways for Buyers and Sellers

Buyers: With more homes available, 2025 presents greater opportunities for negotiating better prices. Flats offer significant affordability benefits, but demand remains focused on houses.

Sellers: Pricing strategically is crucial, especially with upcoming stamp duty changes affecting buyer budgets. While house prices continue to rise, flats may require more competitive pricing to attract buyers.

Manchester’s property market is evolving, and staying informed will be key to making the right investment decisions in 2025. Whether you’re looking to buy or sell, keeping up with market trends can help you maximize value in this dynamic housing landscape.