- Free Valuation

- Competitive Sales Commission Fees

- Free Mortgage Advice

posted 16th September 2025

Manchester’s housing market continued to show strength through August 2025, with faster sales times, steady demand, and prices holding above the national average despite higher stock levels. Affordability has improved, and buyers are active — but pricing strategy is crucial for a quick sale.

Manchester House Price Trends

After falling to just 0.6% growth last summer, house prices across the UK are now showing a more stable trajectory. The average UK home stands at £270,600, up £3,560 year-on-year.

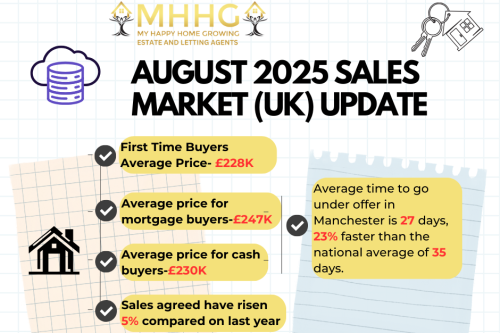

In Manchester, first-time buyers paid an average of £228,000 in August 2025, down from £238,000 in June 2024, suggesting that affordability has improved for new entrants to the market.

Home movers in Manchester paid an average of £280,000 in August 2025, compared with £292,000 a year earlier.

Average price for mortgage buyers: £247,000 (down from £258,000 in June 2024)

Average price for cash buyers: £230,000 (down from £239,000 a year earlier)

This softening in prices, combined with stable mortgage rates, is helping sustain buyer demand even as the number of homes for sale grows.

Demand, Supply, and Pricing Strategy

Buyer demand is up 4% year-on-year, and sales agreed have risen 5% compared with last summer. However, supply has grown faster — the number of homes available for sale is 10% higher than in 2024.

With more choice on the market, buyers are becoming more selective, which is leading to more price adjustments:

One in ten homes had a price reduction in July, well above the five-year average of 6%.

Overpriced homes are taking 2.4 times longer to sell — a clear sign that pricing correctly from the outset is critical.

Manchester Leads in Speed of Sale

Homes in Manchester are selling far quicker than the UK average, reflecting healthy demand.

Region Avg. Time to Sell (Days) Annual Price Change (%)

North West (Manchester) 27 +2.7%

North East 27 2.1%

Yorkshire & Humber 32 2.0%

West Midlands 34 1.8%

Wales 34 2.1%

East Midlands 38 1.3%

The average time to go under offer in Manchester is 27 days — 23% faster than the national average of 35 days. This speed of sale is helping support house price growth in the region, which remains one of the strongest in the country.

Regional Context

While Manchester and the wider North West are seeing quick sales and solid demand, southern regions face more sluggish conditions. In the South East and South West, homes are taking up to 40 days to sell, and price growth is only 0.3% year-on-year.

Coastal markets such as Truro, Exeter, and Bournemouth are particularly slow, with more than a quarter of homes unsold after six months. By contrast, Manchester benefits from relatively tighter supply and strong buyer interest, making it a more dynamic and attractive market.

Tax Policy and Buyer Confidence

Speculation about possible property tax reform — including the potential replacement of stamp duty with an annual property tax for homes above £500,000 — is creating uncertainty in higher-value markets, particularly in London and the South East.

While Manchester’s average prices sit well below these thresholds, this could result in a shift of buyer activity northwards as purchasers look for better value.

Outlook for Manchester

Looking ahead to the final quarter of 2025:

House price growth is expected to remain between 1.5% and 2% nationally, with Manchester likely near the top of this range due to strong demand.

Sales volumes are forecast to be 5% higher than in 2024, with around 1.15 million transactions expected across the UK this year.

Buyer activity should stay strong as affordability improves and mortgage rates remain stable, but sellers must remain realistic with pricing to avoid listings lingering on the market.

Key Takeaways

Manchester is one of the UK’s fastest-moving property markets, with homes typically under offer within four weeks.

Realistic pricing is key — overpriced homes risk sitting unsold for more than twice as long.

Buyer confidence remains strong, supported by improving affordability, which should continue to fuel activity into the end of the year.