- Free Valuation

- Competitive Sales Commission Fees

- Free Mortgage Advice

posted 17th September 2025

Key Takeaways

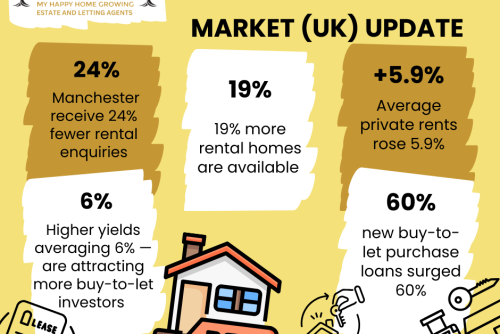

- Manchester rental market cooling: Demand is down 24% compared to last year, while supply is up 19%, creating more balance.

- Annual UK rental growth at 5.9% (12 months to July 2025)— the seventh consecutive month of slowing rent inflation.

- Manchester rents growing at a slower pace, with landlords needing to stay competitive on pricing to avoid longer void periods.

- Average UK rent now £1,300/month, with some regional rental markets seeing slight price falls.

Manchester’s Softest Rental Market in Five Years

Manchester is experiencing the softest rental market conditions since 2020, with 24% fewer rental enquiries compared to last year. This slowdown is closely linked to improving mortgage affordability, which is enabling more renters to become first-time buyers.

At the same time, 19% more rental homes are available compared to a year ago, driven by new landlord investment and a strong buy-to-let pipeline. Homes now take an average of 16 days to find a tenant, up from 12 days in 2024, but still faster than the pre-pandemic average of 20 days.

The result? Rental growth has slowed to just 2.4% year-on-year, less than half the pace of 2024. While this represents a market rebalancing, landlords should note that well-priced, well-marketed properties are still letting quickly.

MHHG Insight:

At MHHG Estate Agents, we’ve observed that competitively priced, well-presented homes are still letting quickly — often within 10 days. Our marketing strategy, professional photography, and targeted tenant-matching system have helped landlords secure quality tenants even as demand softens.

UK Context: Rents & Prices Cooling but Still Rising

Across the UK, average private rents rose 5.9% in the 12 months to July 2025 — lower than June’s 6.7% growth and marking the seventh month in a row of decelerating rental inflation.

Landlord Investment Boosting Manchester Supply

Higher yields — averaging 6% nationally — are attracting more buy-to-let investors back into the market. According to Q1 2025 data, new buy-to-let purchase loans surged 60%, increasing the number of available rental homes.

For landlords in Manchester, this means more competition to secure tenants. A proactive approach — competitive pricing, high-quality property presentation and excellent service — will be key to minimising void periods.

MHHG Advantage:

MHHG helps landlords maximise their return on investment by providing in-depth yield analysis and local market insights. Our dedicated landlord services team supports you with pricing strategies, compliance advice, and tenant retention plans to reduce void periods.

Manchester Market Dynamics

Manchester continues to benefit from its growing job market, university presence and international appeal, keeping demand above pre-pandemic levels. However, affordability constraints are becoming more visible, with many renters at their limit after five years of strong rent growth.

Some landlords are choosing to hold rents steady or offer incentives (such as longer tenancy agreements or furnished units) to attract quality tenants.

Looking Ahead: Opportunities for Landlords

Rental demand is expected to stay above pre-2020 levels but will remain more balanced as additional stock comes to market.

Rental inflation forecast: ~3% for 2025.

House price outlook: Gradual growth as mortgage rates stabilise.

Landlord strategy: Competitive pricing and strong marketing will remain critical to minimise voids and attract quality tenants.

MHHG’s Commitment:

Our team is focused on helping Manchester landlords succeed in this new market reality. From portfolio expansion opportunities to rent reviews and compliance, we are your partners for sustainable returns.

Review rents quarterly: Pricing too high risks longer voids in a market where tenants have more choice.

How MHHG Estate Agents Can Help You

- Market-led rental valuations to set the right price from day one

- Professional marketing – photography, video tours, and online exposure

- Tenant screening & management – find and retain the best tenants

- Portfolio growth advice – identify high-yield investment opportunities

Speak to our lettings specialists today to review your property portfolio and see how we can help you stay ahead of the market.