- Free Valuation

- Competitive Sales Commission Fees

- Free Mortgage Advice

posted 13th September 2024

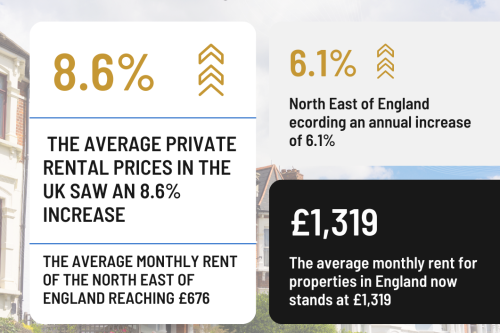

In the 12 months leading up to July 2024, the average private rental prices in the UK saw an 8.6% increase, consistent with the rise observed in June 2024. The rental market remains under considerable pressure due to high demand and limited supply, especially in key regions across England. The average monthly rent for properties in England now stands at £1,319, marking a significant growth in rental costs as affordability concerns mount.

London Leads the Charge

London continues to experience the highest rental inflation, with rents surging by 9.7% over the year. This sustained rise in the capital reflects the ongoing housing supply issues and high demand, driven by both domestic and international renters seeking homes in one of the world’s most expensive cities. With the average rent in London reaching £2,114, affordability is a growing concern, pushing many residents to consider alternative housing options outside of the city center.

North East Sees Modest Growth

In contrast, the North East of England remains the region with the lowest rent inflation, recording an annual increase of 6.1%. This moderate rise, though relatively lower compared to other parts of England, still highlights the region's gradual upward trend in rental prices, with the average monthly rent reaching £676. While this is far lower than London’s soaring costs, it still reflects the broader national trend of rising rents.

Manchester Market: Strong but Balanced Growth

As a key market in the North West, Manchester continues to see steady growth in rental prices, although it does not match London’s steep increases. The annual rent inflation in the North West sits at 7.5%, slightly above the national average, showcasing Manchester’s strong position as a hub for renters seeking a balance between affordability and urban living. The city’s appeal to young professionals, students, and families has kept rental demand high, particularly for well-located properties in the city center and its surrounding areas.

In Manchester, the average monthly rent remains more affordable compared to London, making it an attractive option for those seeking vibrant city life without the extreme rental costs. However, as demand remains high and supply tight, the market is experiencing steady rent inflation, creating challenges for first-time renters and those looking to upgrade to larger properties.

Regional Overview

Across other regions of England, the West Midlands experienced a strong annual rent increase of 9.0%, closely following London in terms of growth. This region's affordability, combined with strong job growth and improved transport links, has made it a key area for renters, contributing to rising demand and upward pressure on rents. The South East and South West also saw significant rental inflation at 8.8% and 8.7%, respectively, indicating that rental pressures are not confined to major cities alone but are spreading to more suburban and rural areas.

Demand Outstripping Supply

The rising rental prices across England can be attributed to several factors, including a mismatch between tenant demand and available rental stock. According to the Royal Institution of Chartered Surveyors (RICS), tenant demand saw a modest increase in July 2024, while the number of new landlord instructions declined. This imbalance between supply and demand is driving rents higher as tenants face increasing competition for available properties. The decreasing number of listings, particularly in highly sought-after areas, suggests that the flow of new rental properties onto the market is slowing, further intensifying rental pressures.

Outlook for the Remainder of 2024

Looking ahead, the rental market is expected to remain competitive for the rest of 2024. As landlords face increasing costs from mortgage rate hikes and property management expenses, these are likely to be passed on to tenants, adding to the upward pressure on rents. In Manchester, this trend may persist, especially in popular neighborhoods such as Ancoats, Deansgate, and the Northern Quarter, where demand remains robust.

In conclusion, while London continues to dominate with the highest rent inflation, cities like Manchester are not far behind in experiencing strong growth, driven by a high demand for rental properties. Renters across England are facing a challenging market, with affordability concerns at the forefront as rents continue to climb.